Hundreds of Satisfied Clients

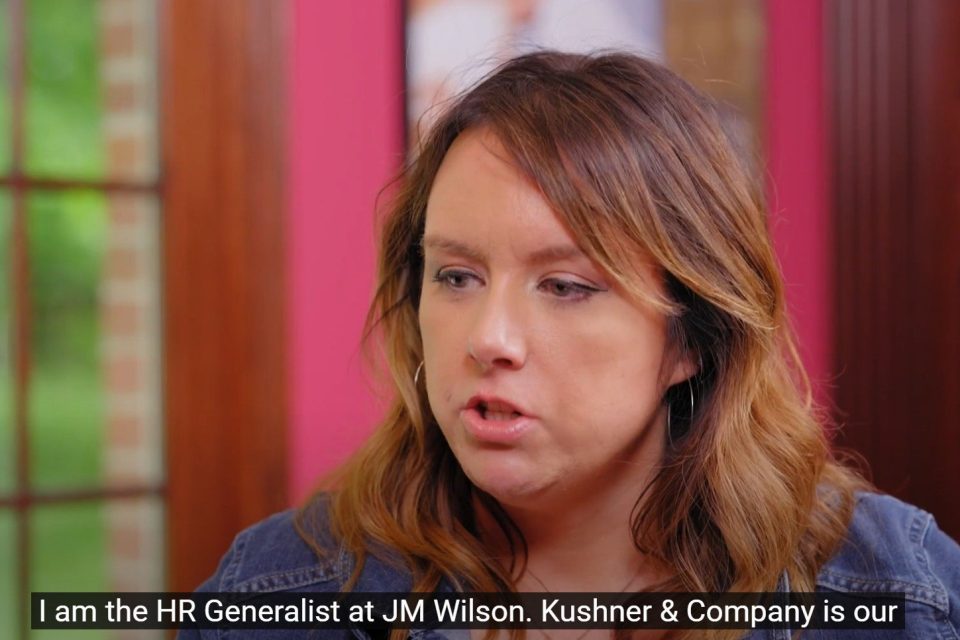

We have found the team at Kushner & Company to be knowledgeable and amazingly responsive to our calls, always providing expert answers that meet our business’ and employee’s needs.

–Chris Murphy

Our employees always report high levels of satisfaction with the outstanding customer service that Kushner provides. I would heartily recommend Kushner & Company to any organization.

–Leanna Fabean

I have the pleasure of working with Kushner & Company, and I can’t say enough about their customer service. It’s rare to find a team so dedicated to providing top-notch support.

–Emily Dush

Give Your Employees the Attention They Deserve

401(k)

401(k) plans are a specialty of Kushner & Company. Determining which one or which combination for a specific employer with its own organizational goals and objectives is essential to achieving plan success and the ability to attract, retain, and engage employees.

Profit Sharing Plans

Profit sharing plans enable an employer to determine each year if it wishes to make a contribution to assist employees in saving for retirement. A profit-sharing plan often is used to incent organization-wide performance and profitability.

Money Purchase Pension

Money purchase pension plans are an older style of plan, but many still exist today. Historically, these plans were used to assist employers in augmenting their total plan contributions. Kushner & Company is able to serve as a third-party administrator (TPA) of these types of plans.

Combo Plans

By linking your organizational and HR strategies to a qualified retirement plan approach, Kushner & Company can combine the different plan types into one plan to achieve those goals. Combo plans often use a cash balance component with a 401(k) or 401(k) Profit Sharing Plan.

Cash Balance Plans

Cash balance plans have become very popular as a retirement planning tool, often found in professional service practices such as doctors, lawyers, engineers, CPA firms, and others, where an older business owner or highly paid employees haven’t saved significantly for retirement.

Plan Document Services

Kushner & Company assists employers in reviewing their existing plan documents for compliance, and in creating new or amended plan documents for their attorneys to review. Our team will produce a plan document with an IRS Opinion Letter tailored precisely to your needs.

Let’s Optimize Your Organization’s Success

Trusted by Companies Nationwide

Make Employee Attraction and Retention Easier

Kushner & Company’s team of retirement plan specialists provides extensive expertise, complete objectivity, and comprehensive solutions. Whatever the size and complexity of your organization, we have a solution to design and administer a 401(k) profit sharing or other retirement plan that best fulfills your and your employees’ needs. Backed with one-on-one attention from your assigned retirement expert, we give you peace-of-mind that your plan complies with all government laws and regulations and that your employees get the attention they deserve.

Some of our new and plan takeover retirement services include:

- Plan design and document preparation and plan amendments

- Summary Plan Descriptions (SPD)

- Required participant notices

- Employee eligibility and vesting determination and tracking

- Allocation of employer contributions and forfeitures

- Compliance testing and reporting

- Required IRS Form 5500

- Participant’s Summary Annual Reports

We believe that small organizations can have the same strategic and operational success as the largest firms.

Kushner & Company believes this can be accomplished in cost-effective ways that increase employee engagement with their employer, making employee attraction and retention much easier. Our mission is straightforward: to optimize organizational success through HR and benefit expertise.